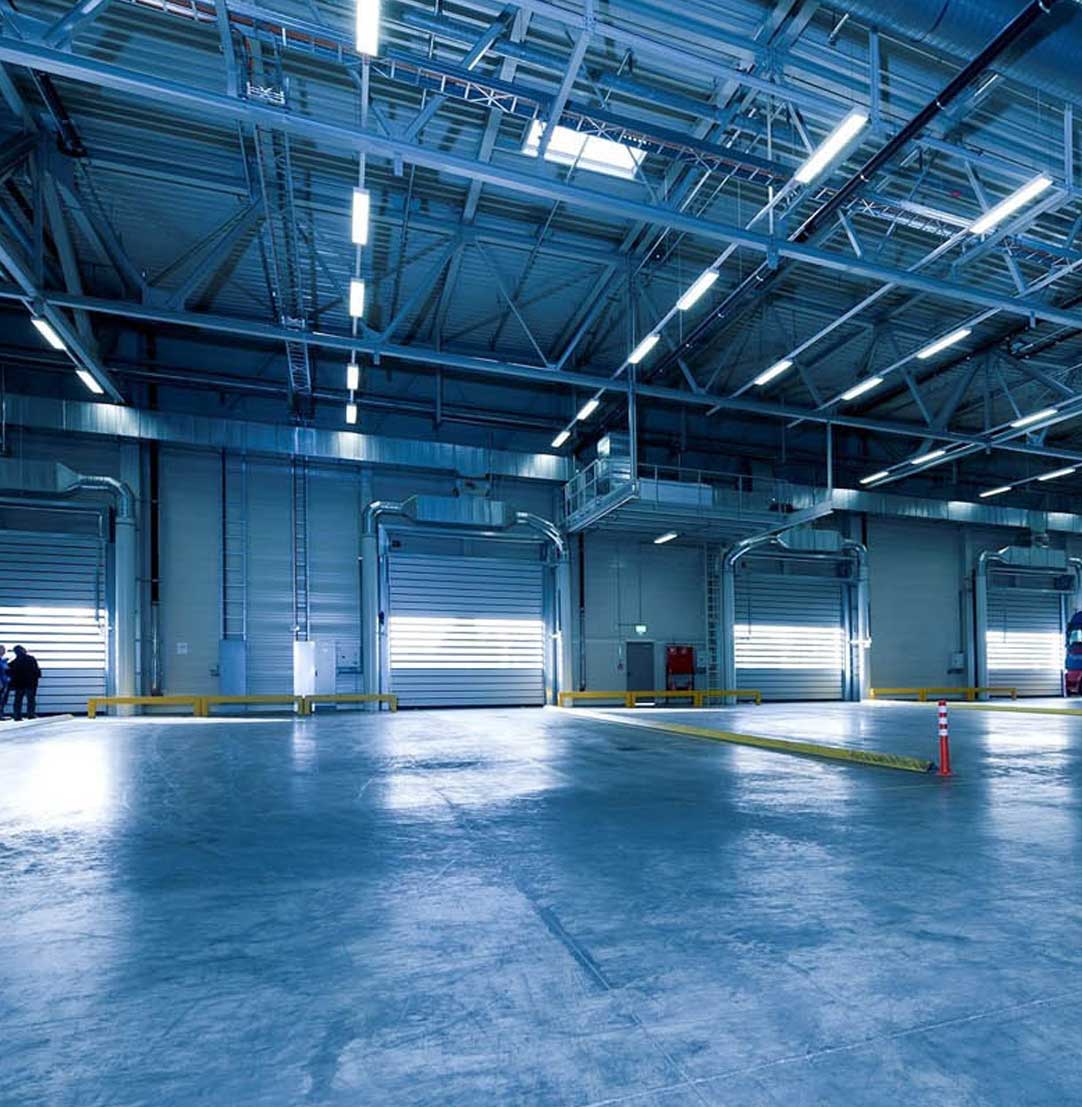

Own Your Workspace

Control your destiny

Why pay rent month after month that gets you nowhere when you could increase equity and realize the benefits of appreciation over time?

Have a property that meets your specific requirements.

Over $1 billion of loan capital available from over 100 lenders.

Owning your commercial real estate comes with significant benefits

No more negotiating with landlords on HVAC, electric, walls or finishes. By purchasing, more commercial space than your immediate requirements, allowing you alternative revenue streams to help cover costs of mortgages and maintenance. Ownership gives back. In many areas there are incentives for green roofs, solar or other sustainability measures.

OWNER/OPERATOR LOANS

retail outlets and convenience centers

Become a part of main street in Anytown, USA

Access funds to purchase, renovate or build your new facility.

SBA OWNER OPERATOR

HARD MONEY LOANS

PRIVATE FINANCING

HARD MONEY LOANS

For businesses with aggressive deadlines, hard money loans can provide funds within 24 hours. Hard Money is a relatively short term loan. Payments are often interest only during the loan term until the deadline for securing long-term financing.

By shopping your loan to the right networks, we match you to private lenders who understand your business goals and objectives. Let’s see what is out there for you.

Start a conversation today.

Over $1 billion of loan capital available from over 100 lenders.