Acquire Commercial Property

Timely and tailored funding options

There is an old saying, “If you had the knowledge and the money, you would have done it already.” You have the knowledge!… You just need the money!

Premier Business Finance has the lender network to handle the size of your funding requirements, at competitive rates by lenders who make funds available quickly.

Over $1 billion of loan capital available from over 100 lenders.

Property managers, investment clubs, retirement funds and corporate financial managers

purchase revenue generating investment properties for reliable cash flow and long-term appreciation. The only thing holding them back is the funding to capitalize on the opportunity. Whether you are seeking a loan to expand low cost housing in your area, or need to act fast to capitalize on premium locations, we have lenders ready to help you make your plan a reality.

Hotels

Multi-family housing units

Office and Retail Lease

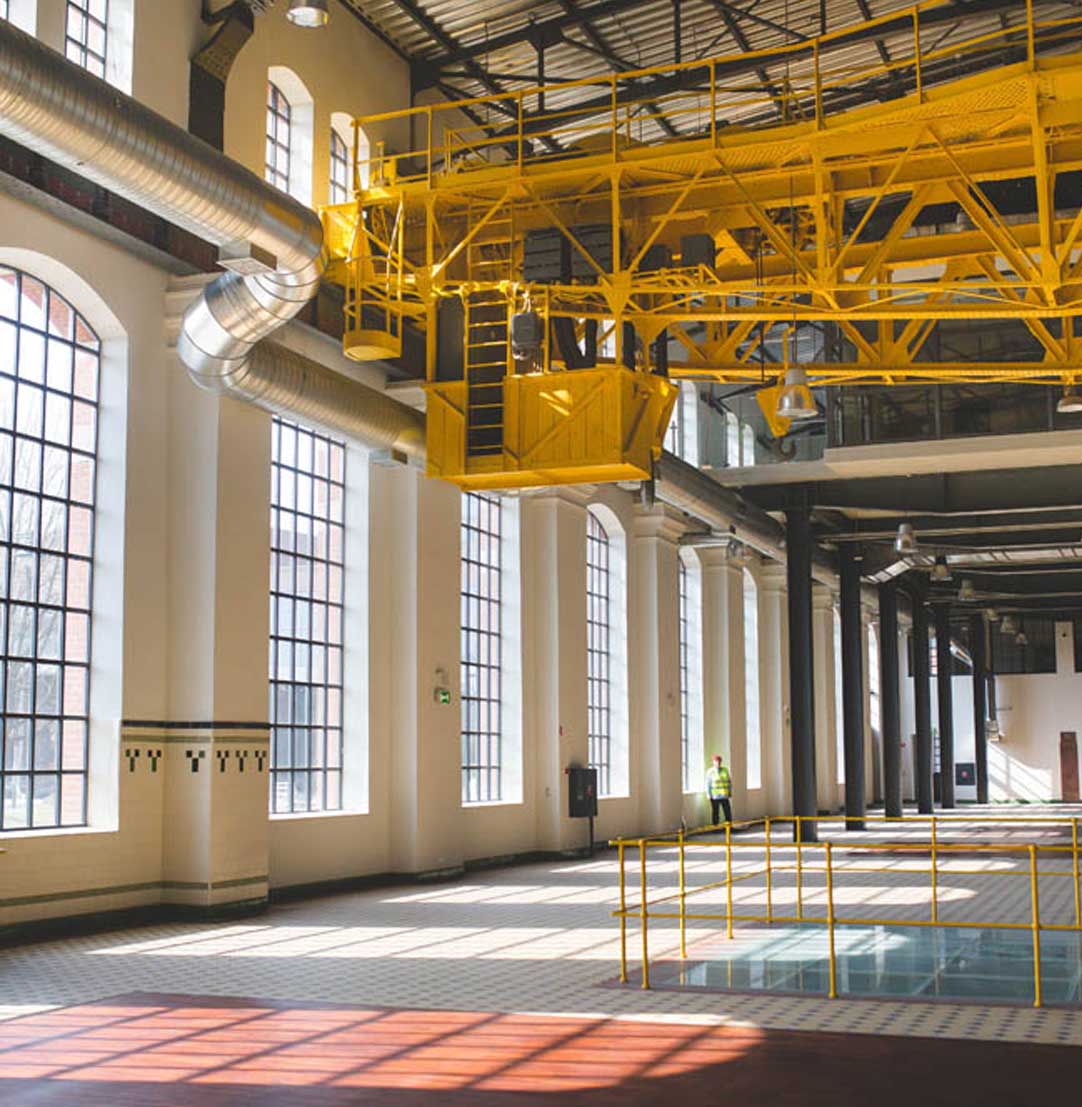

Industrial Investment property

Land acquisition

There are many ways to access capital

We will help you find the best solution.

BRIDGE LOANS

PERMANENT FINANCING

SBA 504 LOANS

SBA 7A LOANS

CRE loans come in many shapes and sizes, and from a broad variety of lenders. Our team works to understand your circumstances to match you to the right lender and loan terms.

Small Business Administration backed 504 loans give your business a broad scope of borrowing options. With loans available from $125,000 to $20 million with down payments as low as 10%. These loans turn previously unobtainable projects into a reality.

Start a conversation today.

Over $1 billion of loan capital available from over 100 lenders.